After retirement, regular income and capital safety become the top priorities for senior citizens. To address this need, the Government of India offers the Senior Citizen Savings Scheme (SCSS), a trusted and low-risk investment option specially designed for people above a certain age.

SCSS is one of the most popular post-retirement schemes because it provides stable quarterly income, tax benefits, and government-backed security. Below is a complete and detailed explanation of SCSS for 2026, covering eligibility, interest rate, tax rules, withdrawal conditions, and much more.

⭐ What is Senior Citizen Savings Scheme (SCSS)?

The Senior Citizen Savings Scheme is a government-backed savings scheme available through post offices and selected banks. It is meant to provide senior citizens with a steady flow of interest income after retirement, along with safety of principal amount.

The scheme is regulated by the Government of India and is considered one of the safest investment options for retirees.

⭐ Senior Citizen Savings Scheme – Key Highlights

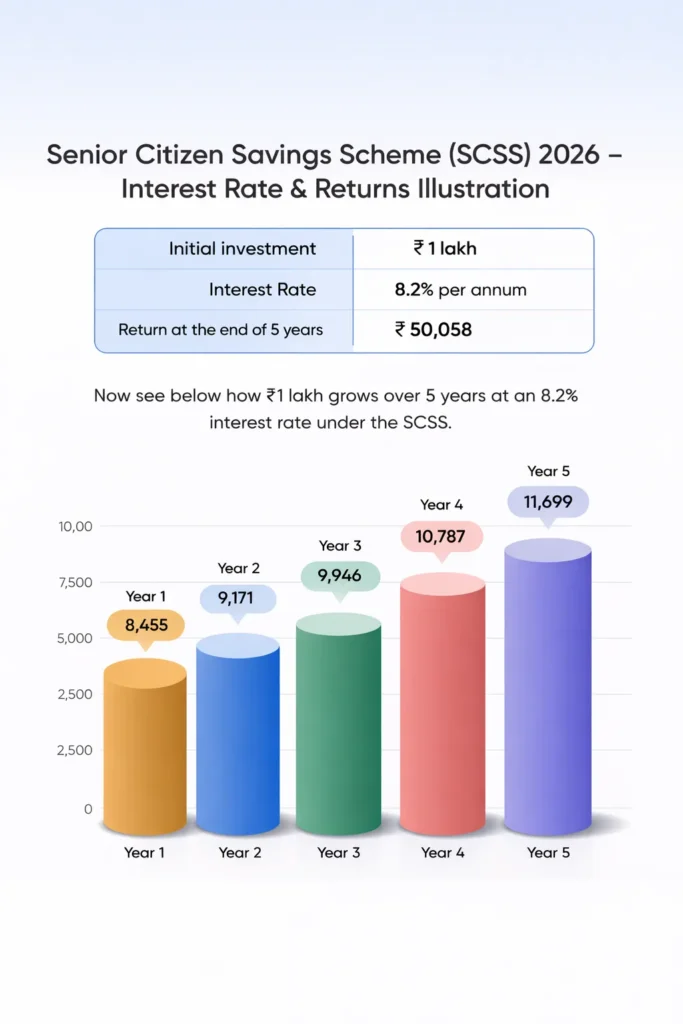

- Interest Rate: 8.2% per annum

- Interest Payout: Quarterly

- Maturity Period: 5 years

- Extension: Up to 3 more years

- Maximum Deposit Limit: ₹30 lakh

- Tax Benefit: Deduction under Section 80C

- Risk Level: Very low (government-backed)

⭐ Eligibility for Senior Citizen Savings Scheme

The following individuals are eligible to open an SCSS account:

- Individuals 60 years or above

- Retired civilian employees aged 55–60 years, within 1 month of receiving retirement benefits

- Retired defence employees aged 50–60 years, within 1 month of receiving retirement benefits

- Account can be opened:

- Individually, or

- Jointly only with spouse

❌ Who Is Not Eligible?

- Non-Resident Indians (NRIs)

- Hindu Undivided Families (HUFs)

📌 PAN and Aadhaar are mandatory for opening an SCSS account (applicable since 31 March 2023).

⭐ Features of Senior Citizen Savings Scheme

🔒 Safe and Secure Investment

SCSS is fully backed by the Government of India, ensuring guaranteed returns and capital protection.

👥 Multiple & Joint Accounts

- A senior citizen can open multiple SCSS accounts

- Joint accounts are allowed only with spouse

- Entire deposit amount is attributed to the first account holder

🧾 Nomination Facility

- Nominee can be added:

- At the time of account opening, or

- Any time later during the tenure

💰 Deposit Rules

- Minimum deposit: ₹1,000

- Maximum deposit: ₹30 lakh

- Deposits must be in multiples of ₹1,000

- Cash deposit allowed only up to ₹1 lakh

- Above ₹1 lakh, payment must be via cheque or bank transfer

For retired employees, deposit amount should not exceed retirement benefits and must be deposited within one month of receiving them.

⭐ What Are Considered Retirement Benefits?

- Provident Fund (PF) dues

- Gratuity

- Commuted pension value

- Leave encashment

- Group Savings Linked Insurance Scheme

- Retirement benefits under Employees’ Family Pension Scheme

- Ex-gratia payments under VRS or SVRS

If deposit exceeds the allowed limit, the excess amount is refunded immediately.

⭐ Transfer of Senior Citizen Savings Scheme Account

An SCSS account can be:

- Transferred from post office to bank

- Transferred from bank to post office

- Shifted from one city/state to another across India

⭐ Tax Benefits Under Senior Citizen Savings Scheme

- Deposit amount qualifies for deduction under Section 80C (up to ₹1.5 lakh)

- Interest earned is taxable

- TDS applicable if:

- Interest exceeds ₹1 lakh per year (for senior citizens)

- Interest exceeds ₹50,000 (if account holder is below 60)

📌 Withdrawals from SCSS accounts are tax-exempt from 29 August 2024 onwards.

⭐ Premature Closure & Withdrawal Rules

SCSS allows premature closure, but with penalties:

| Period of Closure | Penalty |

|---|---|

| Before 1 year | Entire interest paid is recovered |

| 1–2 years | 1.5% of principal |

| After 2 years | 1% of principal |

- Premature withdrawal allowed only once

- Closure application must be submitted in Form 2

⭐ Maturity & Extension

- Original tenure: 5 years

- Extension: Up to 3 years

- Extension request must be submitted within 1 year of maturity

⭐ Senior Citizen Savings Scheme Interest Rate

| Particular | Details |

|---|---|

| Interest Rate | 8.2% per annum |

| Revision | Every quarter |

| Compounding | Quarterly |

| Payout Dates | 1st April, July, October, January |

Interest is directly credited to the linked savings account.

The image below shows how returns grow under the Senior Citizen Savings Scheme over a five-year period.

⭐ Banks & Institutions Offering SCSS

SCSS is available through:

- All major post offices across India

- Selected public and private sector banks including:

- State Bank of India

- Bank of Baroda

- Punjab National Bank

- ICICI Bank

- Union Bank of India

- Canara Bank

- Indian Bank

- Many others

⭐ Documents Required to Open Senior Citizen Savings Scheme Account

- Two passport-size photographs

- Proof of identity (Aadhaar, PAN, Passport, Voter ID)

- Proof of address

- Proof of age

- All documents must be self-attested

Conclusion

The Senior Citizen Savings Scheme (SCSS) remains one of the best investment options for retirees who want safety, predictable income, and tax benefits. With a high interest rate of 8.2%, quarterly payouts, and government backing, SCSS is ideal for long-term financial stability after retirement. For more clear, reliable, and step-by-step guides on savings schemes, taxes, and government benefits, visit Sarkari Bakery.